By: McKaia Dykema, Legislative Specialist, NLC Federal Advocacy & Yucel Ors, NLC Federal Advocacy Program Director, Public Safety

This past month, the Senate Committee on Banking, Housing and Urban Affairs held two hearings on the Reauthorization of the National Flood Insurance Program (NFIP) as a continuation of efforts in Congress to reach a bipartisan agreement to reauthorize the NFIP. The first hearing was focused on community stakeholder perspectives on flood risk in their respective areas and what they believe can be done through the NFIP to mitigate, address or assist. The second hearing was for members of the committee to hear administrative perspectives from the Federal Emergency Management Administration (FEMA), the federal agency which oversees the NFIP, which included FEMA presenting their 17 legislative proposals to be considered with reauthorization. Since Fiscal Year 2017, there have been 21 short-term reauthorizations of this program – conversations initiating a bipartisan agreement for a long-term reauthorization is a positive indicator to communities that the risk of flooding may have more permanent measures in the future under this program. Unless Congress reauthorizes the NFIP, the program will expire on September 30, 2022. Long-term reauthorization is necessary to ensure stability in the financial stability of the insurance program that protects millions of homes and businesses across the country.

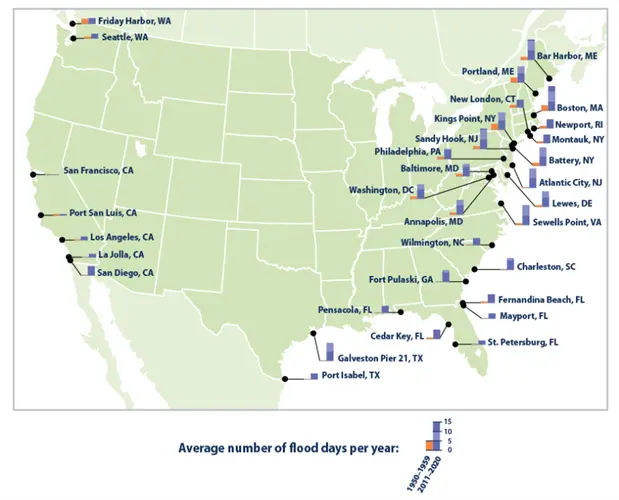

Flooding, as the most frequent type of natural disaster, has long been recognized as a risk for coastal communities, yet you only need to look recently to the flood that occurred in Yellowstone National Park (Wyoming) damaging critical infrastructure, to see that flooding is occurring beyond coastal areas. Below is a visual from the Environmental Protection Agency showing a historic number of flood days per year for just coastal areas.

What is the National Flood Insurance Program?

Congress created the National Flood Insurance Program (NFIP) in 1968 to make affordable flood insurance available to homeowners, renters, and business owners. The NFIP makes federally backed flood insurance available in states and cities, towns, or villages that agree to adopt and enforce flood-plain management ordinances to reduce future flood damage. This program is essential in assisting home or business owners (including local governments) recover faster after a flooding disaster strikes. While FEMA administers the program, NFIP is a partnership between the federal government, local officials, states, property and casualty insurance industry, lending institution, and property owners.

Since most home insurance policies do not cover flooding, flood insurance is a separate policy that can cover the home or building that was impacted along with the contents in the structure. There are approximately 23,000 participating NFIP communities, and certain homes or businesses may be required to have flood insurance in high-risk flood areas if they have a mortgage from a government backed lender.

The Administration and Congress are using the recent hearings and conversations to identify how the NFIP might change or how it might stay the same with a reauthorization this year. One focus through the conversation has been on what the NFIP is meant to do. A theme from the hearings and FEMA is that the NFIP should not just be to help with recovery after a flood, but also to reduce the damage of the flood and to comprehensively reduce flood risk (mitigation).

This past spring, FEMA made a list of 17 legislative proposals to be considered in the new reauthorization of the NFIP. Click here to view a summary of the specific requests from FEMA. Additionally, the legislative proposals were summarized in four different categories below:

- Ensuring more Americans are covered by flood insurance by making insurance more affordable to low-and-moderate income policyholders.

- Building climate resilience by transforming the communication of risk and providing Americans with tools to manage their flood risk.

- Reducing risk, losses, and disaster suffering by strengthening local floodplain management minimum standards and addressing extreme repetitive loss properties.

- Instituting a sound and transparent financial framework that allows the NFIP to balance affordability and fiscal soundness.

How are Cities Impacted?

While the recent hearings present a positive indicator that Congress is aiming to reauthorize the NFIP on a long-term basis with bipartisan language considering recent testimony from community and agency stakeholders, the NFIP must be reauthorized by September 30, 2022, to continue authorizing new policies and have adequate funding for claims. Without this long-term extension, there will continue to be uncertainty about the future of flood insurance rates for businesses, residents and disaster resilience and disaster resilience.

In addition to just the reauthorization of the program, FEMA’s legislative proposals have the potential to have greater impact in communities that are part of the NFIP. It is unlikely but possible that all 17 of FEMA’s legislative proposals are incorporated into the final reauthorization bill, but the inclusion of additional regulatory language for participating municipalities through proposed measures such as requiring higher standards for minimum flood-risk reporting requirements will have direct impact on participating cities, towns and villages or local governments looking to participate.

NLC believes that legislation reauthorizing the NFIP must keep flood insurance rates affordable for primary, non-primary and business properties while balancing the fiscal solvency of the program. NLC’s policy also urges the federal government to work with state and local governments and other stakeholders to develop an incentive-based disaster insurance and mitigation system that would encourage property owners to retrofit existing structures to reduce future losses from natural disasters.

Local governments that are not participants in the NFIP but would like to become a participating community, should refer to this FEMA webpage tailored for local governments. Municipalities can also contact their FEMA Regional Office or the NFIP State Coordinating Agency for more information on how to join. These offices will provide further information, an application, sample resolution and a model floodplain management ordinance.

Other Resources

- FEMA Flood Insurance Website

- Fact Sheet on Flood Insurance

- FEMA Flood Mitigation Assistance Grant Program

- Coalition for Sustainable Flood Insurance (CFSI)

- NLC Resolution on the NFIP (page 240 in the National Municipal Policy)

This article was published by the National League of Cities on their CitiesSpeak Blog. For further content from NLC’s CitiesSpeak Blog, please visit https://www.nlc.org/citiesspeak/.